In order to receive the funds from your charges, you’ll need to

associate a bank account to your Stripe account and start receiving

transfers. You can update your bank account information at any time, and

you can also customize how frequently transfers are made.

Setting Up Your Bank Account for Transfers

Associating Multiple Bank Accounts for Different Currencies

Bank Accounts with Multiple Signors

Viewing Your Bank Account Information in Dashboard

Updating Your Bank Account Information

Transfer Schedules

Your First Transfer

Minimum Volume Thresholds Before Transfers

Automatic Transfers

Transfer Failures

Alternative Transfer Schedules

Setting Up Your Bank Account For Transfers

To receive transfers from Stripe, you’ll need to provide us with bank

account details so that we know where to send your funds. The type of

information required for a successful transfer depends on where your

bank is based.

| Country |

Information |

Example Data |

| Australia |

BSB

Account Number |

123456

12345678 |

| Canada |

Transit Number

Institution Number

Account Number |

12345

987

Format varies by bank |

| Denmark |

IBAN |

DK5000400440116243 |

| Finland |

IBAN |

FI2112345600000785 |

| Ireland |

IBAN |

IE29AIBK93115212345678 |

| Norway |

IBAN |

NO9386011117947 |

| Sweden |

IBAN |

SE3550000000054910000003 |

| United Kingdom |

IBAN |

GB82WEST12345698765432 |

| United States |

Routing Number

Account Number |

111000000

Format varies by bank |

Countries in Beta

| Country |

Information |

Example Data |

| Austria |

IBAN |

AT611904300235473201 |

| Belgium |

IBAN |

BE12345678912345 |

| France |

IBAN |

FR1420041010050500013M02606 |

| Germany |

IBAN |

DE89370400440532013000 |

| Italy |

IBAN |

IT60X0542811101000000123456 |

| Japan |

Bank Name

Branch Name

Account Number

Account Owner Name |

いろは銀行

東京支店

1234567

ヤマダハナコ |

| Luxembourg |

IBAN |

LU280019400644750000 |

| Netherlands |

IBAN |

NL39RABO0300065264 |

| Spain |

IBAN |

ES9121000418450200051332 |

Countries in Private Beta

| Country |

Information |

Example Data |

| Mexico |

CLABE |

123456789012345678 |

| Portugal |

IBAN |

PT50123443211234567890172 |

| Singapore |

Bank Code

Branch Code

Account Number |

1234

123

123456789012 |

| Switzerland |

IBAN |

CH9300762011623852957 |

Required Bank Locations

Bank accounts must be located in the country where their currency is

based–for example, USD banks accounts must be based in the United

States, SEK bank accounts must be based in Sweden, etc.–though there are

a few exceptions.

- Canadian businesses can transfer funds to USD bank accounts that are based in Canada.

- EUR bank accounts can only be based in one of the European countries where Stripe is currently live or in beta.

- GBP bank accounts can also be based in Ireland if the bank supports transfers via BACS.

Bank Accounts with Multiple Signors

Non-profits and similar organizations will often have bank accounts

where multiple people must sign for access. The increased security that

banks offer with multiple signors is used to protect changes to the

account itself, but does not apply to regular ACH transactions into and

out of it. As long as your bank account is setup to receive ACH

payments, we will be able to transfer funds to it.

Associating Multiple Bank Accounts for Different Currencies

Stripe users in some countries are able to connect multiple bank

accounts in order to make transfers in multiple currencies and avoid

conversion fees. In these cases, you can connect one bank account for

each supported currency.

Take a look at our full list of supported bank account currencies to see what is supported in your country.

Default Bank Account Currency

If you have multiple bank accounts, you’ll also need to assign one of

your bank accounts as your default. If you receive any charges that are

in a currency that you do not have a bank account for, they will be

converted to your default bank account’s currency.

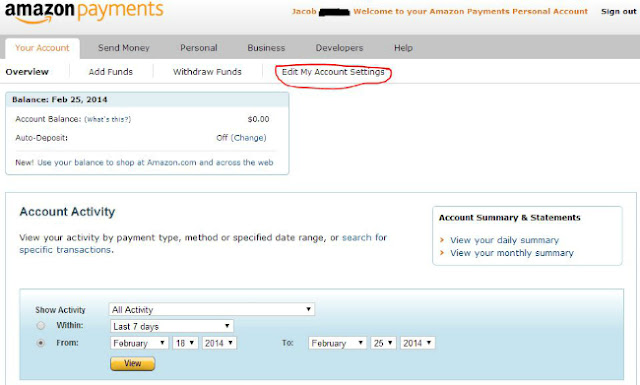

Viewing Your Bank Account Information in Dashboard

You can log in to your Stripe dashboard to view the routing or transit number of your bank, as well as a redacted version of your bank account number.

For security reasons we don’t show the full, unredacted number in the

dashboard, and similarly we aren’t able to tell you over email what

your account number is.

If you’re unsure of the account number you entered, the best way to

be confirm it is to re-enter the number in your account settings in your

dashboard.

Updating Your Bank Account Information

If you need to update your bank account information, you just need to head to the transfers tab in your account settings. From there, you’ll have the opportunity to change your bank account at any time.

We’ll start submitting transfers to your new bank account as soon as

you update your account settings. Due to the time that it takes for your

bank to receive the funds, some transfers may have already been

submitted but not yet reached your account. Those transfers will still

be sent to the old account.

Here’s a quick demo of how to view and update your bank account information:

Your First Transfer

Once you’ve made your first charges with Stripe, your first transfer

will be initiated and should post within 7 days. Note: this is 7 days

after your first charge and not 7 days after you create your account.

The exact timing of your first transfer can vary depending on many

factors. If you have not received your funds by 7 days after your first

charges, you should verify that the transfer hasn’t failed for some reason and that your bank account information has been entered correctly.

All charges are processed on UTC Time

so the processed date may not be the same as the date on which a charge

is made in your local timezone. Most banks will post received funds on

the same day as they are received. On occasion, banks may take 2-3

additional days to post funds. Also, keep in mind that transfers that

are scheduled on weekends or holidays won’t be accepted by your bank

until the next business day.

You can view a list of all of your transfers as well as the date that

they are expected to be received in your bank account from your dashboard.

Minimum Volume Thresholds Before Transfers

For most Stripe users, there are no minimum volume thresholds that

you’ll need to meet before a transfer is initiated. However there are a

couple exceptions.

- GBP bank accounts have a minimum transfer of £1.00.

- CHF bank accounts have a minimum transfer of 25.00 CHF.

- NOK, DKK, and SEK bank accounts have a minimum transfer of 20.00kr.

Automatic Transfers

By default your account will be set to automatically transfer your

account balance on a regular schedule. That default schedule depends on

your country.

| Schedule |

Description |

Countries |

| 2 Day Rolling |

Transfers are made daily and are composed of the payments that were processed two days prior.*

Example: August 1st charges are deposited by August 3rd, and August 2nd charges are deposited by August 4th. |

United States

Some United States users in higher-risk industries will be required to use a 7 day rolling transfer schedule.** |

| 7 Day Rolling |

Transfers are made daily and are composed of the charges that were processed seven days prior.*

Example: August 1st charges are deposited by August 8th, and August 2nd charges are deposited by August 9th. |

Australia, Canada, Denmark, Finland, Ireland, Norway, Sweden,

United Kingdom, Austria, Belgium, France, Germany, Italy, Luxembourg,

Netherlands, Spain, Mexico, Singapore, Switzerland

Some United States users in higher-risk industries.**

|

| Japanese Weekly |

Transfers are made weekly on your preferred day of the week and

are composed of the charges that were processed between 11 days and 4

days prior*

Example: If transfers are scheduled on Wednesdays,

charges from Sunday of the previous week until Saturday of the previous

week are deposited every Wednesday. |

Japan |

* All charges are processed on UTC Time

so the processed date may not be the same as the date on which a charge

is made in your local timezone. Most banks will post received funds on

the same day as they are received. On occasion, banks may take 2-3

additional days to post funds.

** For users in some higher-risk industries in the United States, we

require a short period to monitor your business activity before enabling

the standard 2 Day Rolling schedule in the United States. This delay is

necessary to protect users, cardholders, and Stripe from fraudulent

activity. This in no way indicates that we think your account is

fraudulent—we strive to offer services to a huge variety of businesses

and a few bad actors can require that we take a more cautious stance for

some of our users.

Transfer Failures

If your bank account is not able to receive a transfer, your bank

will return the funds to us. Banks can take up to 5 business days to

inform Stripe about transfers that did not go through, at which time we

will notify you via email and in your dashboard about the issue.

To ensure that your bank account is correct, we’ll prompt you to

input your bank account information again. Once you’ve confirmed your

banking details, Stripe will automatically re-try any failed transfers

using the new information. You won’t need to take any further action.

If you are certain that your banking details are valid, and your

transfer fails anyway, you have the option to resume transfers manually

via the “Resume Transfers” button that will be visible in your

dashboard.

For a full list of the possible transfer failure states check out our documentation.

Alternative Transfer Schedules

If you would like to transfer funds to your bank account on a weekly

or monthly basis–rather than Stripe’s automatic transfers schedule–you

may change your transfer payout schedule in your account settings.

You’ll find the “Change schedule” option within the Transfers

area of your account settings. This is also where you can confirm which

transfer schedule has been selected for your account (either a rolling

basis, weekly or monthly).

For weekly transfer schedules, the administrator may specify the day of the week on which transfers arrive in the bank account.

For monthly schedules, the administrator may specify the day of the

month on which transfers arrive in the bank account. However, if you

choose your transfers to be made on the 31st of the month, your

transfers will be sent on the last day of the shorter months.